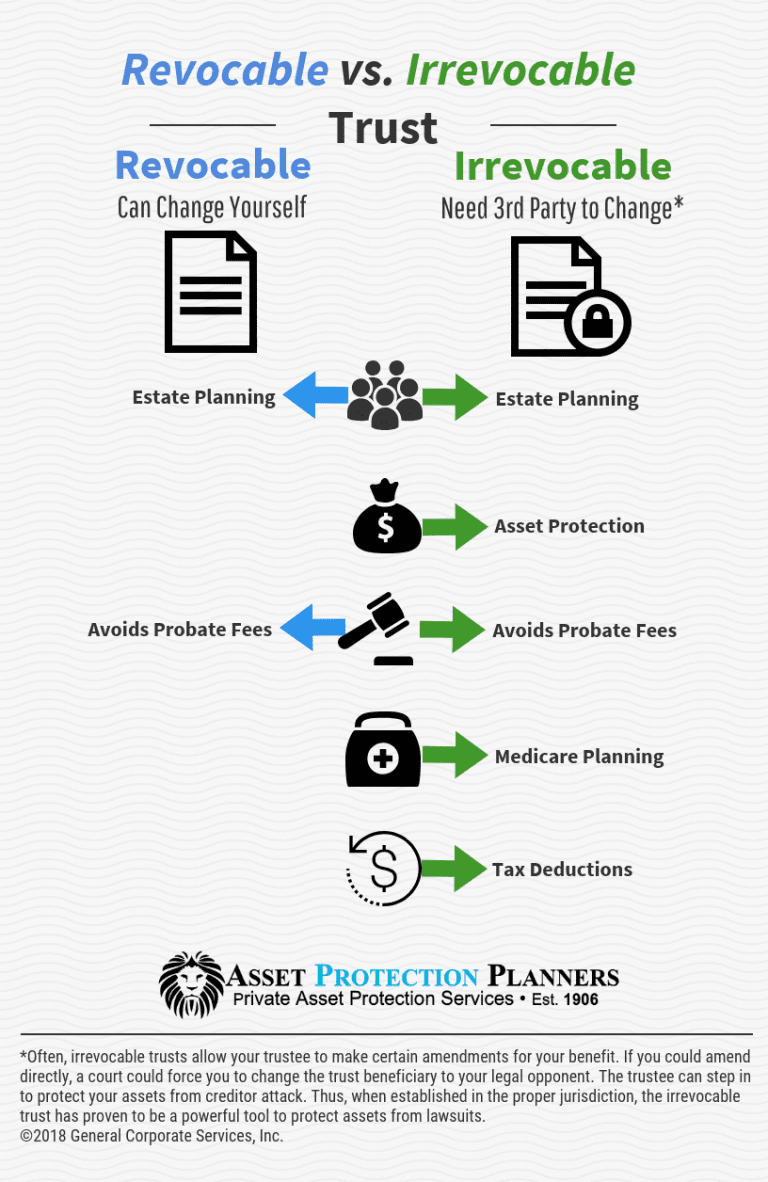

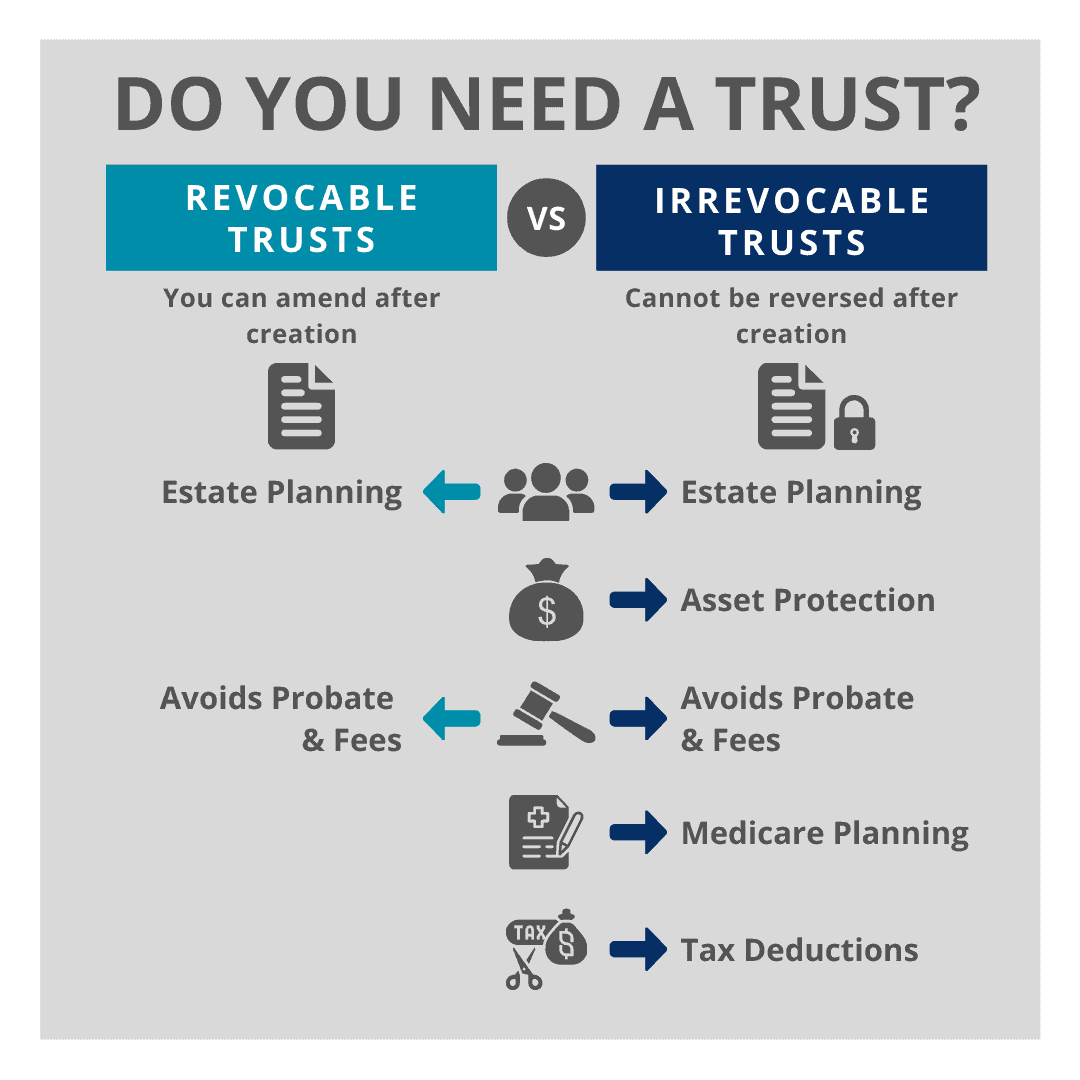

Irrevocable Trust Changes 2025. As its name implies, an irrevocable trust cannot be revoked by the person who establishes the trust. Yet many beneficiaries don’t anticipate how the structure of their trusts may impact.

Yet many beneficiaries don’t anticipate how the structure of their trusts may impact. The sole way to make changes to a testamentary trust (or cancel it) is to alter the will of the trust’s creator before they die.

As described in our previous client memo in may 2025, the fdic is amending its regulations governing deposit insurance to merge the revocable and irrevocable trust deposit.

What is an Irrevocable Trust? How Does It Work? Free Video Explains, The fdic approved changes, on january 21, 2025, to the deposit insurance rules for revocable trust accounts (including formal trusts, pod/itf), irrevocable trust accounts, and mortgage. The internal revenue service (“irs”) issued private letter ruling (“plr”) 201647001 in november.

Revocable Trust or Irrevocable Trust? Sechler Law Firm, Irrevocable trusts are estate planning strategies that. As of 2025, if an irrevocable trust earns more than $15,200 in income that is not distributed out of the trust in that year, every dollar over that amount is taxed at 37%.

How an irrevocable trust protects assets 360 Degrees of Financial, As of 2025, if an irrevocable trust earns more than $15,200 in income that is not distributed out of the trust in that year, every dollar over that amount is taxed at 37%. Trusts are commonly used wealth planning vehicles.

Irrevocable Trust Forms Fill Online, Printable, Fillable, Blank, Decanting can be an efficient way to modify a trust, offering many potential benefits to trustees who might be frustrated administering an outdated irrevocable trust. Planning for those trusts is the focus of this article.

Irrevocable Trusts Protect Loved Ones, Assets Cherewka Law, The fdic approved changes, on january 21, 2025, to the deposit insurance rules for revocable trust accounts (including formal trusts, pod/itf), irrevocable trust accounts, and mortgage. A recent chief counsel memorandum (ccm) issued by the internal revenue service may have a chilling effect on.

Will There Be Taxes Upon Liquidation of Irrevocable Trust After Grantor, The fdic approved changes, on january 21, 2025, to the deposit insurance rules for revocable trust accounts (including formal trusts, pod/itf), irrevocable trust accounts, and mortgage. Planning for those trusts is the focus of this article.

Revocable Vs. Irrevocable Trust ⚖, Trusts are commonly used wealth planning vehicles. In 2025, irrevocable trusts pay tax at the top tax bracket of 37% when undistributed taxable income is $13,450.

About Irrevocable Trusts & QPRTs Chandler & Knowles CPAs, An irrevocable trust may help reduce estate taxes and avoid probate. As described in our previous client memo in may 2025, the fdic is amending its regulations governing deposit insurance to merge the revocable and irrevocable trust deposit.

Hecht Group Why You Should Create An Irrevocable Trust, The sole way to make changes to a testamentary trust (or cancel it) is to alter the will of the trust's creator before they die. The fdic approved changes, on january 21, 2025, to the deposit insurance rules for revocable trust accounts (including formal trusts, pod/itf), irrevocable trust accounts, and mortgage.

What Is the Difference Between a Revocable Trust and an Irrevocable Trust?, The sole way to make changes to a testamentary trust (or cancel it) is to alter the will of the trust's creator before they die. As its name implies, an irrevocable trust cannot be revoked by the person who establishes the trust.

7, a grantor created an irrevocable inter vivos (lifetime) trust for the benefit of the grantor’s descendants and retained sufficient powers.

In 2025, irrevocable trusts pay tax at the top tax bracket of 37% when undistributed taxable income is $13,450.